The Feinstein Fantasy

Today you will be inundated with a flood of falsehoods, just like every other day. Weeks ago, that deluge of fabrications focused on Senator Dianne Feinstein. She was adored in headlines as a trailblazer, centrist stalwart, glass-ceiling-breaker, badass and lioness.

None of that is true, at least not in the sense it was represented. The eldest of three sisters, her father a spectacularly successful surgeon, Dianne grew up in Presidio Terrace, then and now, San Francisco’s most expensive and exclusive little enclave, where the imposing gates and spiked iron bars surrounding it stand tall, to remind commoners they are not welcome to mingle among such aristocracy as lives inside.

According to San Francisco Chronicle biographer Jerry Roberts, the young girls:

wore expensive clothes, were indulged with riding, tennis, and piano lessons, and were treated to white-gloved teas and luncheons at fine hotels and restaurants in fashionable Union Square.

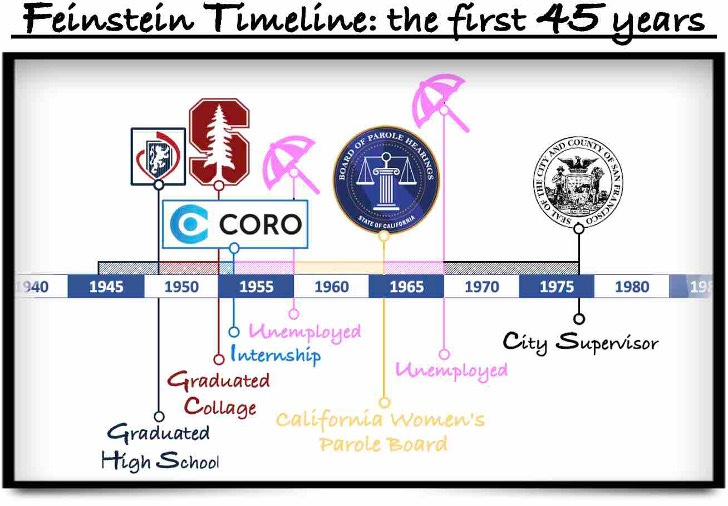

She attended a posh, and expensive, catholic private school in Pacific Heights with million-dollar views of the Bay. Despite her mediocre grades she got in to Stanford University because her dad was rich and her mom was an alumnus.

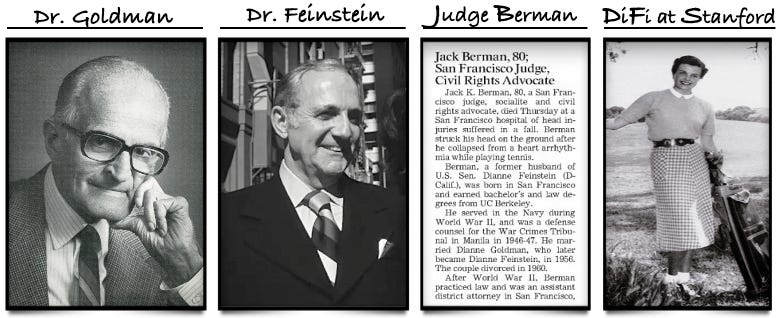

Her marks did not improve at Stanford, forcing her to accept a low-paid internship upon graduation at the Coro Foundation, which grooms affluent young adults for low-paid careers in public service. Assigned to the San Francisco District Attorney’s Office, she met Jack Berman, a young, ambitious, fast-rising prosecutor who went on to become a San Francisco Superior Court Judge. After a brief courtship, they eloped and were married on 02-December-1956. Just shy of eight months later she gave birth to her only child, later known as Katherine Feinstein. Dianne divorced Mr. Berman after less than three years of marriage and hightailed it with their child.

After her one-year internship with Coro Foundation, she took a four-year respite from work. Now divorced, with a dependent of her own, she was still dependent on her father, who introduced her to one of his colleagues, Dr. Bertram Feinstein. Oxford educated, one of the top neurosurgeons in the world, and never married, he had more money than her dad and was closer in age to him than to her too. At the same time, aged 27, she took her first job — lifetime — on the California Board of Parole, as appointed by one of her dad’s patients, Governor Pat Brown. Two years later, on 11-November-1962, she married Dr. Feinstein. She entered the marriage with one child, who Dr. Feinstein promptly adopted, precluding the natural father, Judge Berman, from having any relationship with his daughter. Dr. Feinstein entered the union with one Rolls Royce, one Bugatti, one Austin Martin, and one pedestrian Chevrolet, that he used to beat up driving around San Francisco. Three pictures exist – in total – of the loving couple anywhere on the Internet.

The middle one, a screengrab from a 1970 interview taken in their living room, betrays Mrs. Feinstein’s unbridled affection for her wealthy, older second husband.

Four years into marriage, she resigned from the Parole Board and took yet another three-year break from work before, finally, entering San Francisco local politics with a bang. Bankrolled by her dad, Dr. Leon Goldman, and her husband, Dr. Feinstein, she spent an unprecedented $75,000 running for an entry level office at a time when a three-bedroom home in a comfortable San Francisco neighborhood cost $28,000 (source). She was the first politician in San Francisco history to use TV advertisements (source).

An at-large, forced rank, citywide election, 16 supervisor candidates were on the ballot, the top five to be elected to office. The electorate doesn’t take supervisor votes so seriously, and Doctors Goldman and Feinstein spent so much, that she took first place, which, by the rules, mandated her concurrent appointment as president of The Board of Supervisors. A rookie, Mrs. Dianne Feinstein was handed the gavel immediately after she was sworn in – a San Francisco first. Aged 36, she had claimed her first accomplishment the same way she gained admission to Stanford University: by spending other people’s money. No doubt the grizzled veterans of the Board, all products of low budget, grassroot campaigns, were duly impressed.

Defeat and Love

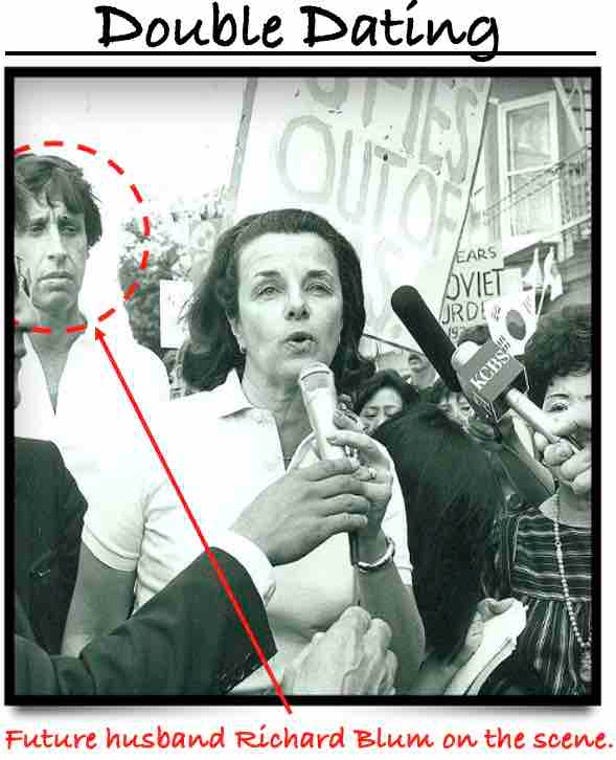

In 1971, as president of the Board of Supervisors her freshman year, she made a bid for mayor, just after moving into her brand-new office, and she spent another ungodly sum on the race. She finished third. She ran for mayor again in 1974, and yet again spent another stack, and the outcome was just about the same: she finished third, but the publicity gained her another short-lived, one-year stint as president of the board. Below Supervisor Feinstein can be seen campaigning for mayor the second time with her future third husband, Mr. Richard Blum, lurking in the background, as he often did. Not long after, Dr. Feinstein was diagnosed with terminal colon cancer.

Death Becomes Dianne

Frustrated by her second loss running for higher office, and perseverant throughout her husband’s illness, Supervisor Feinstein sought to sabotage the elected mayor, George Moscone, also a Democrat, and an established proponent of gay rights, by attempting to build a board alliance to oppose his every move. Frustrated by Dianne Feinstein, the board and the mayor voted in 1977 to change supervisorial elections from being at-large to being localized and voted upon by the districts represented. This triggered upheaval, and swept in a fleet of five new Supervisors: the first open homosexual, the first Black woman, the first Chinese American, the first feminist, and a conservative police officer turned fireman. After the shake up, the board was split 5 to 5, for Moscone and against him, with Dan White, the former cop, the lone swing vote, and set to vote last in the line-up to select the board president. In securing his vote, Supervisor Feinstein gained the 6-5 majority necessary to obstruct Mayor Moscone, and to be reelected president a third time. White, whose campaign manager was openly gay, voted straight-line with the anti-Moscone coalition, except on matters of gay rights, when he flipped and sided with his friend, Supervisor Harvey Milk, who was openly gay.

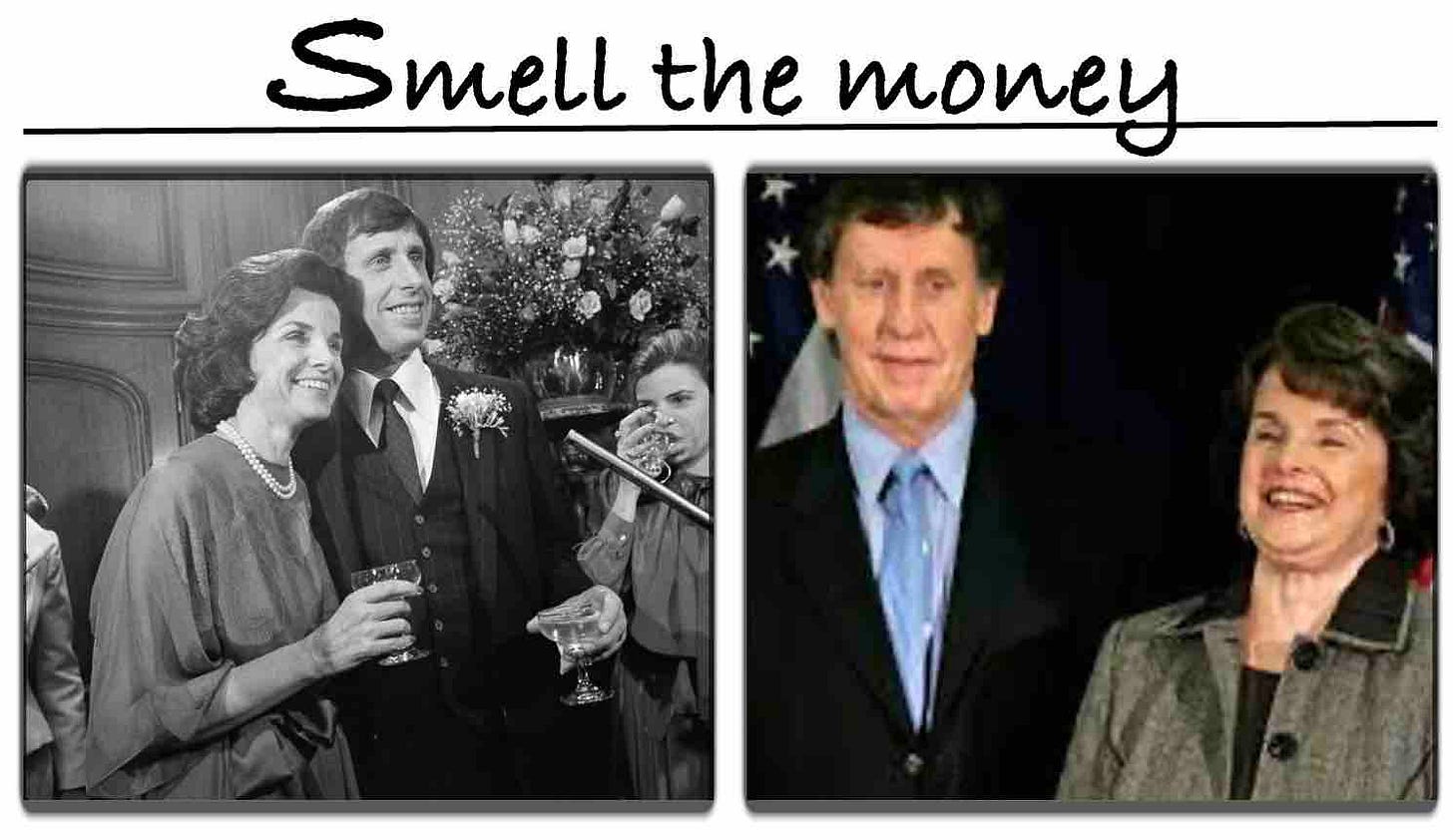

Two things are certain in life – death and taxes – and on 15-April-1978, Dr. Feinstein succumbed to cancer. That same month, the board also voted to allow a halfway house for violent youth offenders in Supervisor White’s district, with the pivotal support coming from Supervisor Milk. Betrayed and dejected, Supervisor White’s behavior grew increasingly erratic. Four days after Thanksgiving the same year, Supervisor White stuffed his .38 police service-revolver in one pocket and two reloads of hollow points in the other. He entered City Hall and shot Mayor Moscone twice while standing before shooting him twice in the head at point blank once grounded. He then reloaded and made his way to Supervisor Milk’s office. Supervisor White shot him four times on his feet before delivering a fifth round to his head, execution style. After that Dan White turned himself in to the Police Station where he once worked. By line of succession, Board President Dianne Feinstein was sworn in as Mayor shortly thereafter. Her third husband, Richard Blum, was immediately on the scene, everywhere with her, from the moment the gun shots rang out, including her announcement of the tragedy to the media.

Ten months after Dr. Feinstein passed, his widow announced her engagement to Blum, who would go on to be her steady partner in crime and corruption for the next 40 years hence.

All About That Money

Before her battlefield promotion, Supervisor Feinstein was known for three things: money, money, and money. She had lots of it, spent lots of it, and flashed lots of it. A member of the Advisory Committee for Adult Detention, she was “a familiar visitor in the jails, wearing her I. Magnin outfits and clicking through the stone corridors on her high heels,” according to San Francisco Chronicle biographer Jerry Roberts. Her campaigns always pulled out all the stops, and she wore around City Hall ensembles that probably cost one-quarter of the $9,600-per-year Supervisor salary at Neiman Marcus.

With incumbency as her tailwind, Feinstein was twice reelected mayor until she was forced out by term limits. She accomplished two things in office: completing the desperately overdue modernization of the San Francisco trolley system, which nobody opposed, and hosting the 1984 Democratic National Convention so she could lobby candidate Walter Mondale for the position as his running mate. He chose Geraldine Ferraro instead. Otherwise, she voted to support her husband’s business interests, which are her own too.

Questions About Corruption Emerge

After sitting out 2 years, she ran for California Governor in 1990 and The Los Angeles zeroed in on her, exposing a string of conflicts from her days as San Francisco mayor:

Dianne Feinstein supported two projects in which her husband’s close associates had financial interests... In one project she lobbied for the sale of land for a new Marriot hotel... The major representative for Marriot was a longtime friend and business partner of Feinstein’s husband... In another project, Feinstein endorsed a plan to build an aquarium at Pier 39... A client of Blum, Texas billionaire Robert M. Bass, and Bass’ three brothers and family, own a majority of Pier 39.

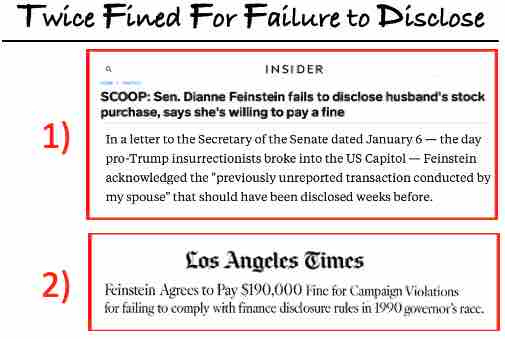

Having bought her first seat in office, as a city supervisor, and then lost two bids for mayor, she had yet to win a serious election in which she was not an incumbent granted office by succession. After spending $3-million of her own dough on the gubernatorial race, for which she was later fined $190,000 because she failed to disclose this, she lost to the spectacularly bland Senator Pete Wilson who is now memorialized in his home town by a bronze statue of him shrugging with his hands in his pockets.

But lady luck blessed Dianne Feinstein once again in 1992, when Governor Wilson picked John Seymour, largely an unknown, who, impossibly, was even more milquetoast than himself, as the replacement for his old senate seat. Against him, she won her first, and only, open election in which she was not an incumbent (excluding her high-priced first run for supervisor).

She won reelection 5 times thereafter, as incumbents always do, even despite losing the endorsement of the California Democratic Party in 2018, which supported State Senator Kevin de León instead.

Seersucker

Adding to her two achievements as San Francisco mayor she passed one law during her 31 years in the senate: 1994’s “ban” on assault rifles, which had more loopholes in it for gun manufacturers than Swiss cheese and expired 19 years ago in 2004. Other than figuring out ways to enrich herself, she spent most of her time celebrating “Seersucker Day.”

She participated in a total of 9 such ferstivities by my count.

However, one would be forgiven for thinking otherwise. The New York Times, alone, published thirteen different pieces praising her greatness and amazingness around her death.

The Old, Accurate View From The Left

This wasn’t always the case. Before she was so recently sainted, Mrs. Feinstein, a conservative Democrat, or a Republican by another name, was disdained by the Left, especially around San Francisco. Larry Bensky, a devout pacifist, opponent of capital punishment, and member of Greenpeace published the below in 1994 in the proudly leftist Anderson Valley Advertiser (LIBERAL?...):

At the time of her first election in 1969… [h]er contributions were led by a wealthy father, an even wealthier husband, and a constellation of powerful business leaders who — correctly — assumed that she would be a safe vote for their interests… She's always been about money… Money is really the best place to start in revisiting Dianne Feinstein's political career.

Every word of that is true. The LA Times went after her again in 1994 too:

A review of the senator’s first two years in office found that Feinstein supported several positions that benefitted Blum, his wealthy clients, and their investments. She was a vocal proponent of increased trade with China while Blum’s firm was planning a major investment there. She also voted for appropriations that provided more than $100 million a year in federal funds for three companies in which her husband is a substantial investor.

Indeed, she was a safe vote for the interests of her contributors, as was predicted by Mr. Bensky, but she advanced nothing zealously than the interests of her husband, Mr. Blum, “an equity fund manager.” Or, well, herself, really: California is among nine states that observe “community property” in marital law, meaning all assets are legally considered owned 50-50 by a married couple. Translation: she was the direct beneficiary of her political actions by law.

The Wealth of Nations

Together, they amassed an absurd fortune. Their portfolio of properties, alone, around her time of death included eight big dollar cherries: 1) an Aspen vacation home, sold recently for $30 million; 2) an 8 bedroom, 9,500 square foot mansion in Pacific Heights, atop the Lyon Street Steps – the crown jewel of ‘Billionaire’s Row’ – and her primary home conservatively valued at $25 million; 3) an investment property in the 161 room Hotel Carlton on Nob Hill, conservatively valued at $55 million; 4) a Maui vacation home valued at $5 million; 5) a Washington DC pied-à-terre valued at $10 million; 6) a Lake Tahoe vacation cabin, sold recently for $36 million; 7) a Stinson Beach weekend home, now listed at $10 million; and 8) her Presidio Terrace home which she gifted her daughter, valued at $10 million.

To hopscotch around their array of vacation alternatives, the couple owned a Gulfstream G650 (outright), which costs $55 million (used). Add up their total property holdings, plus their jet and the sum is $231mm. Guidelines suggest family offices allocate 20% of their assets to real estate, which implies the couple’s total net worth was – ballpark – $1.2 billion. Though she gave it her best shot, it would take 6660 years to earn as much in the U.S. Senate on salary, before even paying taxes. That’s about 420 times the length she served, counting taxes. It’s always 420 somewhere.

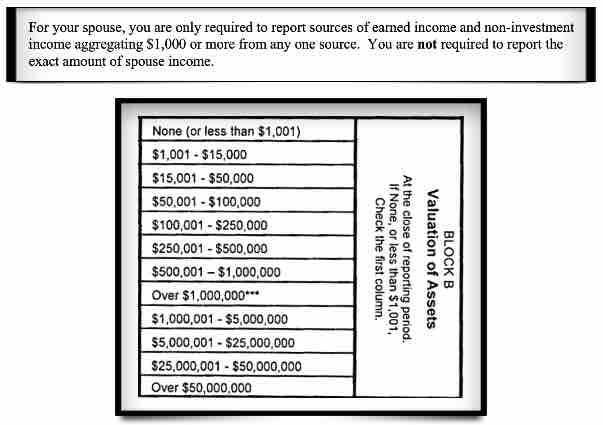

Reflecting the volume of their investing activity, Senator Feinstein’s obligatory 2012 financial disclosure ran 137 pages long; by contrast, Senator Jay Rockefeller, great grandchild of John D. Rockefeller, needed just eight pages. Unfortunately, the disclosure rules also provide Senators wide dollar ranges per asset listed and exempt spouses from disclosing their income. These rules, after all, are made for Senators, by Senators.

To see what Mr. Blum was doing for this living, I started with his Brookings Institute biography from his 2001 appointment to their Board of Trustees.

Seventeen board positions appear on his Brookings resume. He held, at least, another 14 board seats not listed, bringing his total to 31, which doesn’t pass a smell test. Who would want to attend so many board meetings, with four such snoozer gatherings per year? Who could possibly be an expert in all of 31 different industries? Seeing this, the initial assumption was he was taking appointments to monetize selling the senator’s influence. Wrong. The game was much more sophisticated, lucrative and transparent.

Barbarians At the Gate

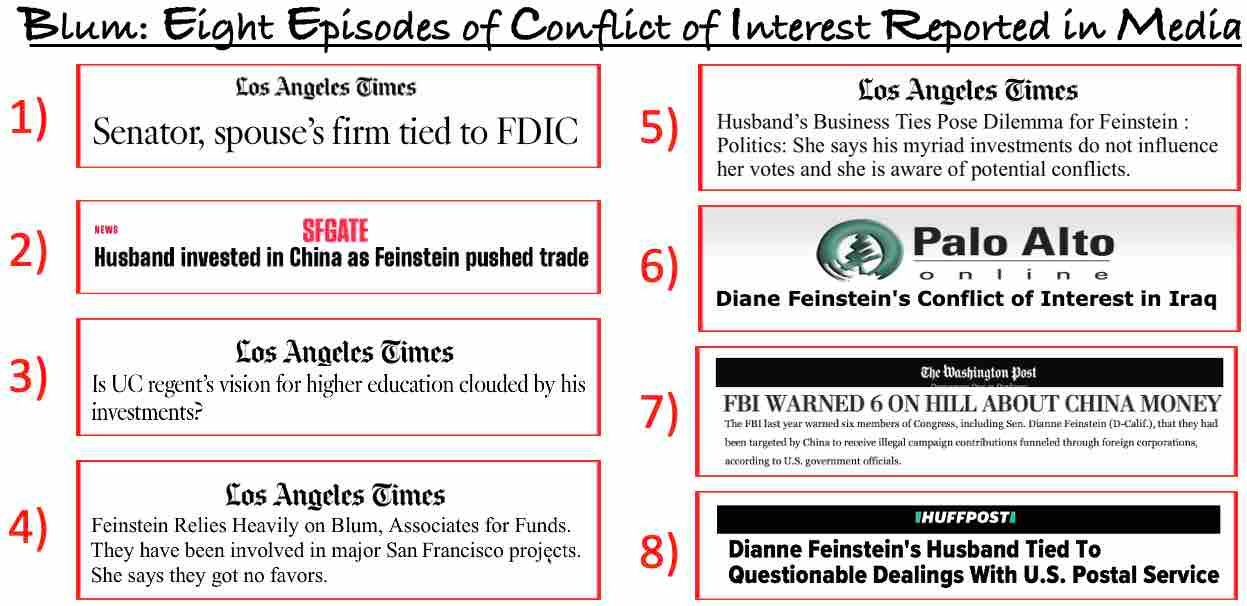

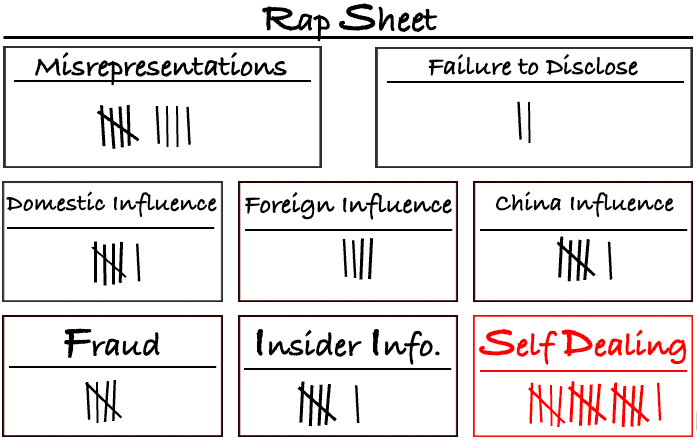

Although the media never focused on these scandals as a wholistic and long-standing pattern of behavior, encountering such a repeated pattern of events – i.e. Mr. Blum attracting scrutiny for gaining a controlling stake in a company with intense government interactions directly within Senator Feinstein’s jurisdiction – evoked a series of similar headlines from the media. Searching for <Feinstein> + <Blum> + <Conflicts>, eight independent incidences of conflicts appeared in the news archive.

Mr. Blum was also implicated in suspicious public market activities three times.

Both Blum and Senator Feinstein also, each, resigned from a significant appointed position under a cloud of controversy created by a conflict one time.

The power couple were also sanctioned with fines, twice, for failing to disclose something material of their financial activities as is required.

Mr. Blum was also appointed to a 12-year term as a University of California Regent in 2002, and was he reappointed in 2014 – each time by a different party-affiliated governor – making him the longest serving member overseeing the largest public university system in the world while he was the largest shareholder in two for-profit colleges, Career Education Corporation and ITT. He was also flagged for influence pedaling when his longtime business partner, Mr. David Bonderman of Texas Pacific Group, was awarded his very first investment mandate from the UC Regents under Mr. Blum’s watch as chairman. URS Corporation, a construction enterprise majority owned by Mr. Blum, was awarded a $125 million, five-year contract for the UC’s Los Alamos facility, and UCLA’s $150 million project to rebuild Santa Monica Hospital, and UC Berkeley’s $48 million nanotechnology laboratory contract, and the $200 million contract for U.C. Berkeley’s Southeast Campus Integrated Project. On top of that, an internal investigation also found that Mr. Blum violated U.C. policy by “seeking to influence inappropriately the outcome of admissions decisions.” To his own admission, he sent letters “a bunch of times” for friends and family to various chancellors at multiple UC campuses once he became a Regent, saying he did this: “Wherever they were applying. Wherever they wanted to get in.” He continued, saying “no one ever told me it was wrong,” and “it’s a bunch of nonsense.” Good thing, too, because otherwise unqualified rich kids, like the young Mrs. Feinstein, might never get into college. Just like her, these kids were mostly white and wealthy.

In 2009, with all the necessary fanfare, including the attendance of the 14th Dali Lama, Mr. Blum was awarded the Berkeley Medal, the university’s highest honor. While the exact total of his admission violations was never disclosed, during just two admissions cycles audited (2013-2014 and 2018-2019), 64 applicants were admitted to U.C. campuses based on claims of exaggerated athletic prowess, family donations, or relationships with campus officials. Among them, 42 were admitted to Berkeley.

Those same two for-profit education companies, ITT Technical Institute and Career Education Corporation, both received massive federal government subsidies via Pell Grants (self dealing). Immediately after being cut off by the federal government, for bad business practices, both went bust. Both were, also, later bagged by law enforcement for widespread fraudulent practices. Somehow Mr. Blum managed to avoid all these consequences too.

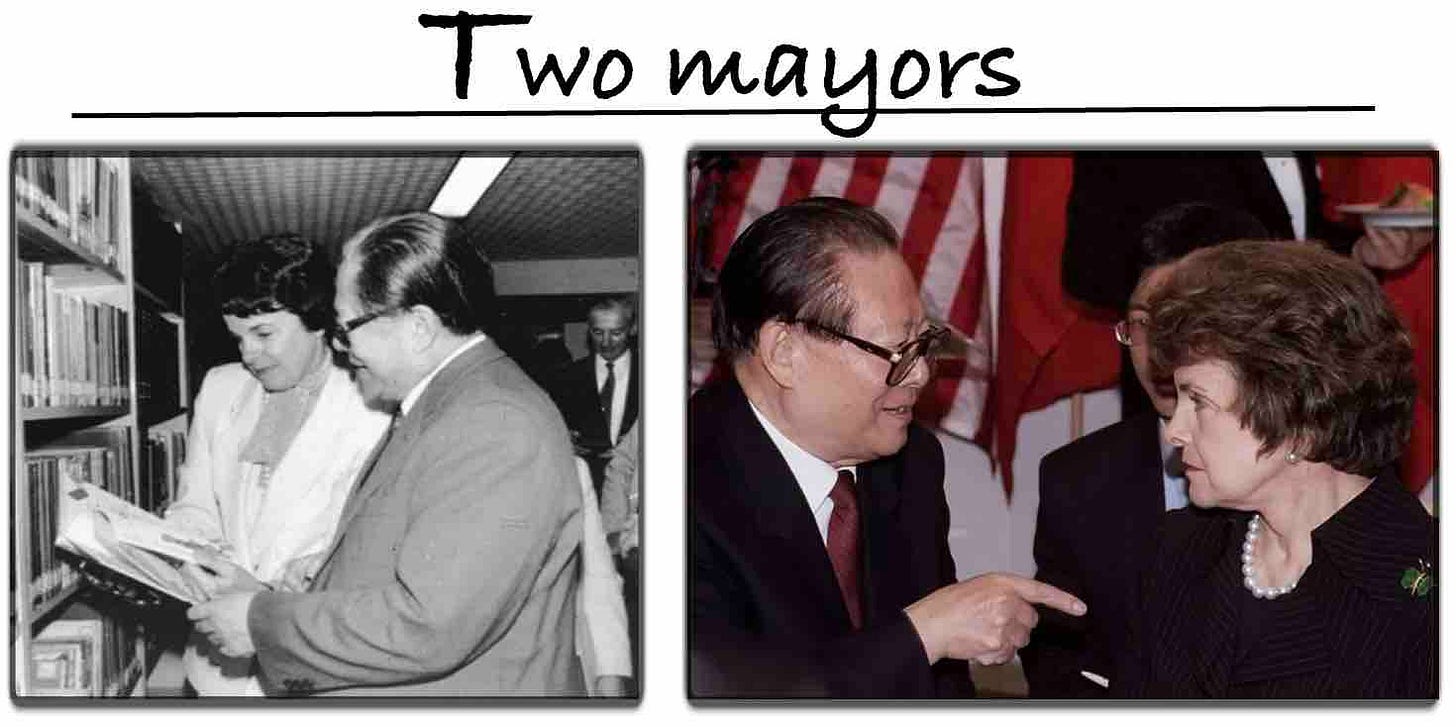

In 1997, Senator Feinstein, along with five other politicians, was warned by the FBI she was a known target of Chinese espionage efforts. Feinstein’s relationship with China dated back to 1979, when she first became mayor, and when Jiang Zemin was himself mayor of Shanghai. The two established a “sister city” relationship. In 1986, Feinstein and Jiang designated several corporate entities as commercial hosts to foster economic interaction. One of them was Shanghai Pacific Partners, where Mr. Blum served as a director.

Over time, Feinstein became a US Senator and member of the Foreign Relations Committee, first, and later chairman of the Senate Committee on Intelligence, while Jiang rose to the top of PRC leadership, ultimately serving as president. Mr. Blum’s Chinese investments, meanwhile, increased in lockstep, while Senator Feinstein became, undoubtedly, China’s most supportive senate advocate. Unblinking, she refused to denounce China’s human rights record throughout. China became her single most common, but also only just occasionally reported upon, source of negative press.

Five months after that warning she suggested the formation of a joint China-U.S. commission to explore “the evolution of human rights in both countries over the last 20 to 30 years” looking at incidents such as “Tiananmen Square and Kent State,” suggesting that a handful of poorly trained National Guardsman who killed four civilian protestors in 1970 was somehow the equivalent of China’s intentional mass murder of hundreds of unarmed students by soldiers with tanks and automatic weapons in 1989. The FBI warning also didn’t stop her from hiring a Chinese spy, either, at about the exact same, who worked for her for some 20 years thereafter, including while she was Chairman of the Senate Intelligence Committee. Repeat: for two decades, a converted Chinese agent, reporting to China’s Ministry of State Security, was her personal driver in San Francisco and “served as her gofer in her San Francisco office and as a liaison to the Asian American community, even attending Chinese Consulate events with the senator,” according to The San Francisco Chronicle.

Add it all up and Senator Feinstein and husband were the subject of at least 19 wholly different controversies reported in the media throughout her career.

The Same Old Song and Dance

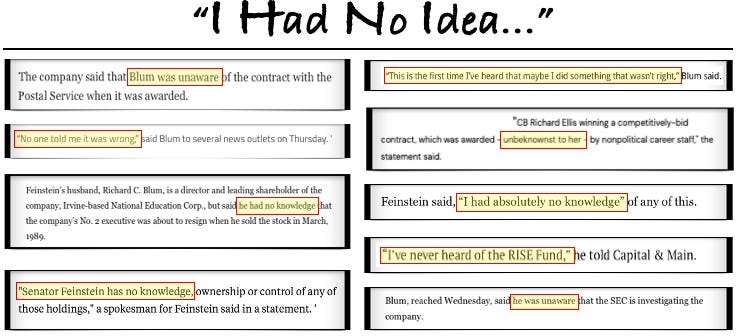

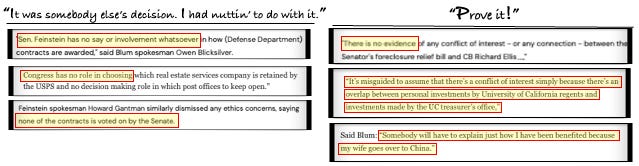

Encountering so many similar situations, the couple developed a patterned, effective routine for evading any serious consequences too. The best offense being a good defense, they steadfastly maintained a drumbeat of suppressing fire, always talking about how they fastidiously avoided any discussions of their work inside their marriage of 40 years, creating a so called “firewall,” no matter how implausible that claim is on its face. Usually, they buttressed this claim by mentioning their “blind trust” investment structure, which might be acceptable if one believed that they never discussed their careers or investments during their four decades of marriage. She also purportedly never spoke about business in front of her chauffer either. To my mind, the top two personal situations in which people are most likely to be indiscrete with secret matters are: in the car with their driver at the wheel and at home with their spouse.

Beyond that, their first line of defense was: “I didn’t even know about this (so, how could I be involved if I didn’t even know about it?)”

They usually supplemented this line with one four helpers: 1) somebody else decided that; and/or 2) prove it; and/or 3) actually, I am the victim here; and/or 4) my big title doesn’t mean anything.

During her unsuccessful bid for governor in 1990 the couple also, somehow, spent $3mm on her campaign, without ever even a mention of it between them.

Blum: Hey honey, I just noticed three million dollars is missing from our joint checking account. Did you spend that on something?

Feinstein: Well, maybe I did and maybe I didn’t. I can neither affirm nor deny it, because to do so would be an ethical violation of my firewall commitment either way, sweetie!

Blum: Oh, ok, honey, I get it. Thanks.

Speaking about the “triathlon of politics” while addressing this matter, Mr. Blum played the victim:

No. 1, we get to see on a regular basis everything she’s ever done and I’ve ever done distorted in the newspapers. No. 2, we get to share 17 years of our tax returns on an intimate basis with 30 million people. And three, I get to pay to watch all this happen.

More, More, More

Looking into the specifics, a clear pattern of brazenness emerges over time as they gained comfort. It started with an airline investment, one year after she took office as a Senator, in 1993, when Mr. Blum’s was appointed to the board of Northwest Airlines. In 1994, Texas Pacific Group founder, David Bonderman, purchased Continental Airlines and took a large stake in America West. Also in 1994, Messrs. Blum and Bonderman formed a joint venture called Newbridge Capital Partners to focus on investing in Asia. One year later, conveniently, Senator Feinstein was assigned to the Senate Foreign Relations Committee. In August 1995, Mr. Blum and Senator Feinstein traveled to China at the invitation of Jiang Zemin. They returned to China together, again, in January and November of 1996. Those were the first of many trips they would take to China together. I am curious how he knew how when to go to their airport without marking these dates in his calendar, or whether he knew where he was going, at all, until he landed?

By 1998, Northwest was under the control of Newbridge. In 2007, Continental and Northwest secured exclusive direct routes to China from their respective hubs granted by the Department of Transportation. In 2008, Northwest was sold to Delta and, in 2010, Continental was sold to United. Punchline: US Government (USG) actions positively impacted the value of their investment, even if not playing a pivotal role.

By 1999, Newbridge had made at least three significant investments in China: China Civilink, Zhongxing-Suntek Data Communication, and North Dragon Iron & Steel. Additionally, in 1999, Newbridge paid $500 million for 51% of Korea First Bank, which fell into IMF receivership during the 1997 Asian Crisis. This transaction required securing approvals from US regulators, the IMF, and the Korean government. In 2005, Newbridge sold KFB to Standard Chartered for $3.3Bn. Punchline: this deal demanded both intense USG interaction, and approvals, plus considerable USG influence on foreign governments. Newbridge sold KFB 6 years later and made 5.6 times their initial investment.

In 2000, The LA Times went at them again, noting these investments, because Mr. Blum had represented he would divest his investments in China but he had not. He also provided assurance he would donate all the profits, too, but whether he did or not remains unclear.

In 2004, Newbridge purchased a 20% controlling stake in Shenzhen Development Bank for $225 million, becoming the first foreign firm to buy a state-owned Chinese national bank since 1949. After the transaction’s terms were agreed and signed, the deal collapsed because of internal Chinese political tensions impacting the seller, which was The City of Shenzhen. The local mayor supported it but the more powerful local Communist Party secretary opposed it. To resurrect this deal, the US ambassador delivered a letter to Chinese premier Wen Jiabao complaining about how Newbridge was being treated and, with that, the deal was back on. Punchline: this deal hinged exclusively on USG applying direct pressure to a foreign government. Newbridge sold SDB to Ping An 7 years later (in 2011) for $3.41bn, making it a ten bagger.

As reported by Peter Byrne, from 1997 to 2005, Mr. Blum was majority shareholder in URS Corporation, and, likewise, he was majority shareholder in Perini Corporation. Both are construction companies that were not involved in defense contracts before Mr. Blum’s arrival. Senator Feinstein, meanwhile, became chairperson of the Senate Military Construction Appropriations Subcommittee from 2001 through 2007 and, in her capacity, she appropriated more than $1.5bn in defense contracts to those two companies which she owned 50% by way of marriage and defense revenue contribution at both companies increased meaningfully during this time. The couple made at least $116mm in profit from this.

Michael R. Klein, a partner at Wilmer, Cutler & Pickering, a law firm that works for the Democratic Party, and a top legal adviser to Senator Feinstein, was vice-chairman of Perini, and was co-owner with Mr. Blum of ASTAR Air Cargo (which was another sweetheart transaction that happened as a consequence of USG activity). In a September 2006 interview, Mr. Klein stated that, beginning in 1997, he routinely informed Senator Feinstein about specific federal projects coming before her in which Perini or URS was involved:

They would get from me a notice that Perini was bidding on a contract that would be affected as we understood it by potential legislation that would come before either the full Congress or any committee that she was a member of. And she would as a result of that not act, abstain from dealing with those pieces of legislation.

The record shows she didn’t abstain. To quell noise from watchdog groups when this came to light in 2007, she quietly stepped down from the MILCON subcommittee, while Mr. Blum sold their positions in the 2 companies.

Mr. Byrne also reported that in 2007, Feinstein co-authored student loan legislation while Blum was buying ITT. Feinstein’s bill enabled ITT to triple its federal student aid revenue and the company specifically applauded the impact of Feinstein’s legislation in its annual report.

SFGATE reported that in 2008, Feinstein introduced legislation to route $25bn of taxpayer funding to the FDIC, which normally is self-funded by member banks, just after the agency selected CBRE to sell foreclosed properties. Feinstein’s intervention was unusual because she wasn’t a member of the Senate Banking Committee which oversees the FDIC. At the time, Mr. Blum was Chairman and majority stakeholder in CBRE. She went back to the well three years later when the US Postal Service decided to liquidate and/or lease its excess post office space. In July 2011, CBRE, where Feinstein’s husband was still Chairman, was awarded an exclusive contract, providing allowance for dual representation (i.e. being both seller’s broker and buyer’s agent on transactions, which permits mixed motives and charging double commission). The first of a handful of critical media reports came out 2 years later, in December 2013. In February 2014, the Postal Service Inspector General came out with a scathing report on the deal, its terms and its results after spot checking a few transactions; however, the report carefully avoided mentioning the self-dealing by Senator Feinstein. The crisis-management strategy deployed by Mr. Blum was a familiar one: in May 2014 he quietly resigned from the board. The Inspector General reiterated the report in May 2015, including the recommendation to terminate and renegotiate the entire contract without CBRE. Finally, in April 2017, the contract was re-awarded to Jones Lang Lasalle.

The Pattern of Escalation

They started out relatively cautiously, yet, over the years, they grew more overt and careless. Northwest Airlines took quite some time to monetize (14 years) and the only help they got from USG was a few exclusive hubs to China versus in the KFB and SDB deals, the investments were both deeply discounted because of the impossible regulatory challenges, unless one’s wife is a U.S. Senator, and both required significant pressure from USG upon foreign governments too. Newbridge was effectively a proprietary trading “warehouse account” where discounted, regulatorily difficult investments could be bought, booked and stored while Senator Feinstein worked her magic to cleanse them of such burdens, in order that they may be resold at full market value later, once liberated, and Mr. Bonderman seems to have represented the private equity transactional expertise needed and the pricing expert necessary to maximize the regulatory spread capture. By the time of URS and Perini, Bonderman was out of the way, and Senator Feinstein, quite simply, was representing the United States while simultaneously doing business, directly, with herself. Along the way, the monetization timelines kept getting shorter and shorter while the profits kept getting bigger and bigger. At the end of their run, Mr. Blum was quintuple-dipping as a UC Regent to exploit every conceivable conflict: 1) taking advantage of the opportunity as a Regent to gather useful information and intelligence to benefit of their pair of for-profit educational investments; 2) getting the University of California to award contracts to URS; 3) getting the first ever UC Regent investment mandate for his business partner at TPG; 4) receiving federal government Pell Grants for their pair of for-profit college investments; and 5) sending some untold number of “inappropriate” letters of recommendation supporting the applications of their friends’ unqualified kids.

How Many More Times?

Looking at it from a prosecutorial lens, as in how many separate incidences arise, and how many violations seem to have happened within each incidence, but without assessing the rough magnitude of each violation – like agnostic to whether a misdemeanor or a felony – and I am counting 54 separate incidents that smell really bad. I left out the spy.

You know, I’m a little too old to believe all these were coincidences and, for $1.2 billion, I don’t know too many people who wouldn’t do just the same, especially if they could get away with it.

What’s Next

This is the first in a multipart series. This weekend: how it all worked, Dianne Feinstein’s manhandling of the media, and the people she unrepentantly trampled for cash along the way, and grander fabrications, plus other related distortions of reality now codified as the truth. The week after: how and why Nancy Pelosi and Dianne Feinstein both became hated by Willie Brown’s San Francisco machine, and how he ran them both over in her final days with an epic set-up, making fools of both, and smashing Nancy’s House Machine, a splinter cell, thereby — perhaps inadvertently — handing the mantle of control within the Democratic party over to Governor Newsom, who, like Dianne Feinstein and Willie Brown, was once mayor of that shambolic town. Something is up with him doing all the campaigning and Biden is polling, well, not well enough. The week thereafter: if America is to become San Francisco under this new guard, then a look at San Francisco by the numbers (i.e. the homelessness rate per capita versus the national average; the spending rate per homeless person versus the national average; the crime rate per capita versus the national average; the drug overdose rates per capita versus the national average; and the city per capita deficit rate versus the civic national average). Week three is a doozie and week two is better than week one. The last one, while reality, is just plain depressing, but it’s nice to know what’s in store, even if it’s horrible.

Thanks for the great sleuthing. This is beyond troubling, but “I’m shocked! Shocked to find that gambling is going on in here! Everyone out at once!” Captain Louis Renault. Your winnings, Sir.” “Oh thank you.” Not much difference between the Casablanca in a Hollywood movie and the reality of the uni party, the legal system and financial community. The State of California is coming to a state near you, just ask the Governor of California. He can’t wait to bring his style of grifting to you. “I thought the French Laundry did dry cleaning, my wife told me to drop off my suits, how was I to know there was a birthday party going on, foie gras, grass fed beef from Argentina and $500.00 a plate before the $1000.00 bottles of wine from my vineyard? Geesh...Just when you think the reprehensible can’t get worse, they prove us wrong.

... and she couldn’t take any of it with her.